Standard Operating Procedures

Standard Operating Procedures

<Reversing a Billed Transaction>

DRAFT WRITTEN BY IT/NEEDS FUNCTIONAL REVIEW AND APPROVAL

Purpose

At times transactions will be billed in KFS and there will be a decision to reverse the billing. The actual reversal of the billing occurs in KFS but should be reflected in AiM to keep the billing data and reports accurate.

Procedure

There is a series of steps that need to be coordinated with other billing activities to ensure proper execution of the reversal:

- Create the Work Order Journal Entry that negates the transaction(s)

- Execute billing so that the Work Order Journal Entry is reverse billed in AiM

- Approve the Work Order Journal Entry in Billing

- Mark the Work Order Journal billing extracted so they do not go to KFS

- Create the 2nd Work Order Journal Entry to accurately capture the costs as non-billed

- Set the Phase to a non-billable status so that the non-billed costs are not billed in KFS

| Collect the information in AiM about the transactions that were billed that need to be reflected as reversed | |

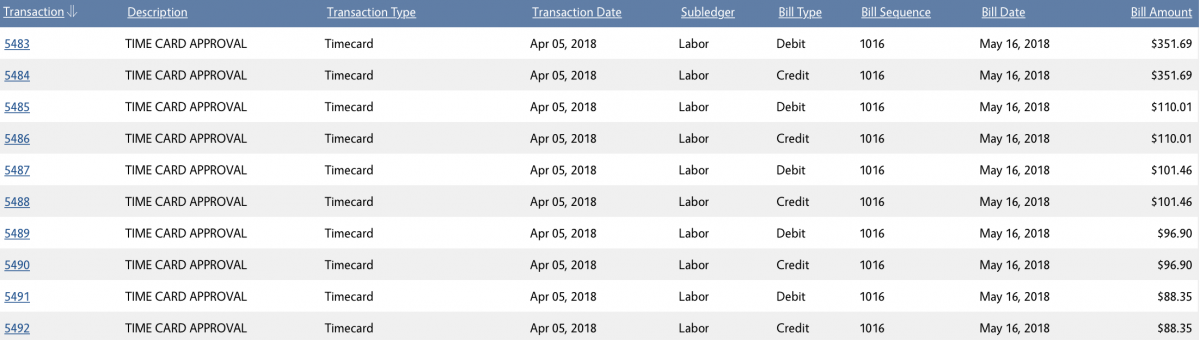

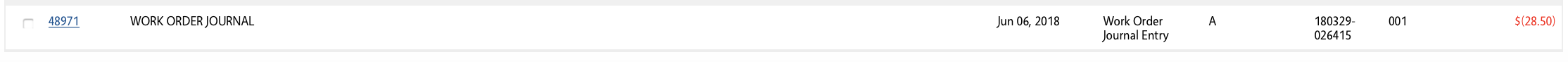

| Identify the billed transactions that need to be reversed. On the screen to the right is a sample set of transactions that were billed but now need to be reversed |  |

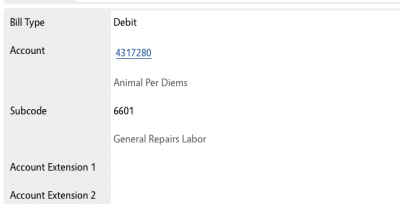

| Note the credit and debit accounts that are reflected in the billing that needs to be reversed. To see this click on the transaction number link in the screen above and scroll down to see the bill type and the account information |   |

|

Note that to correctly reflect billing amounts in AIM it is not necessary to reverse each line individually and reversals can be grouped for efficiency |

|

From AiM WorkDesk:

|

|

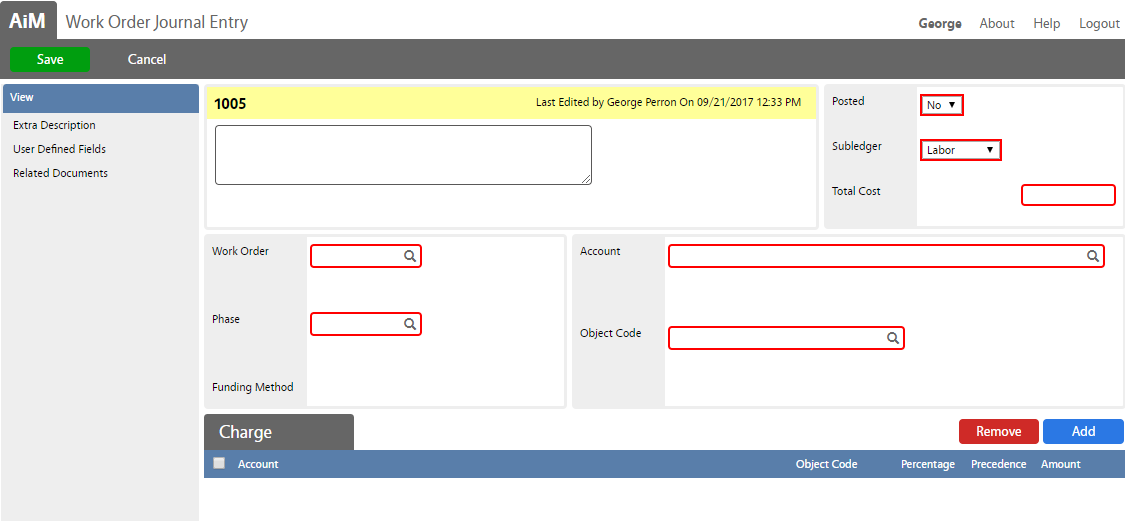

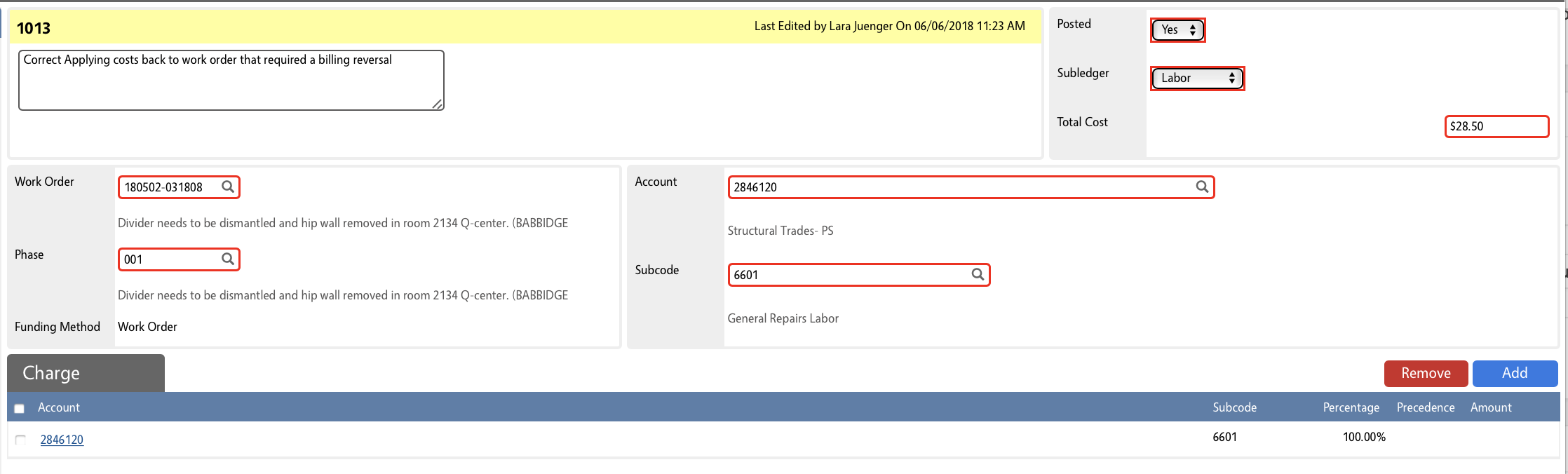

| Enter WO Adjustment information:

A. Enter Description (TO DO: Facilities define standard for reversal descriptions)

|

|

| Change the Posted value to Yes after confirming all the data is entered correctly | |

| Run the Billing Process | Standard Operating Procedures for executing billing can be found here |

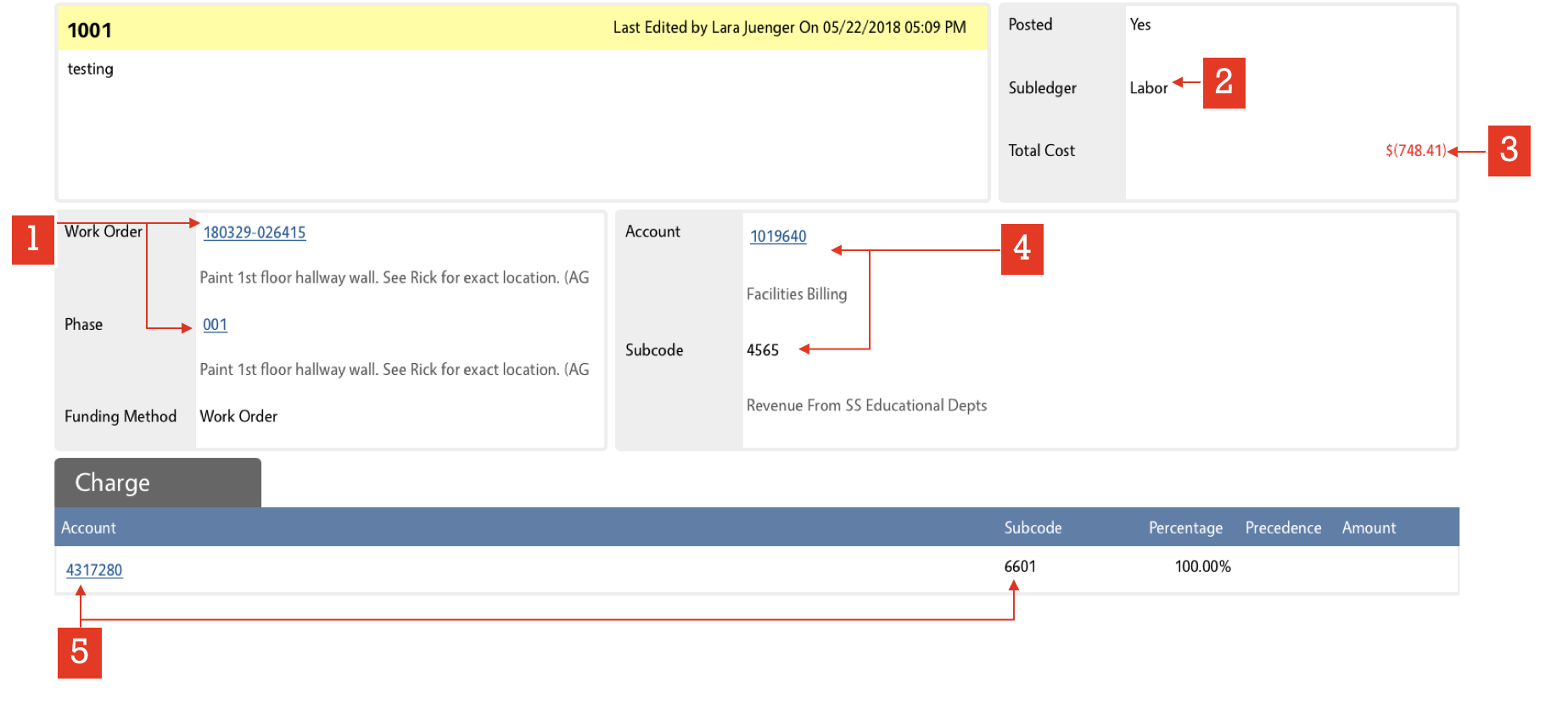

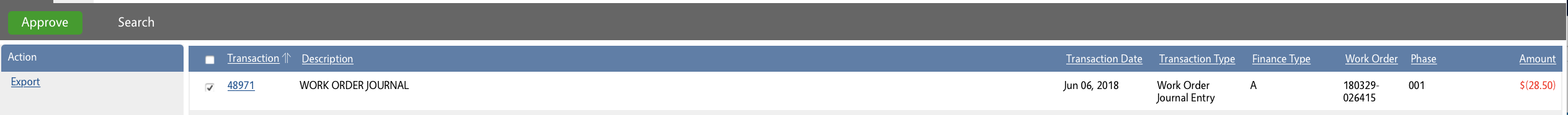

| At the approval step confirm the work order journal entry was processed as expected. Click on the linked transaction number to review any details |  |

| Once comfortable check the box next to the transaction number and click the green Approve button in the upper left corner of the screen |  |

| The transaction is now set to export to KFS, but the reversal is already processed in KFS. If no other billed transactions are staged to export ask the administrator to mark this entry exported |  |

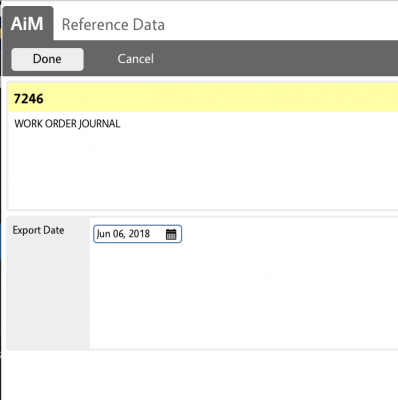

| If you prefer to manually set the journal entry to extracted, access the reference data section of the billed transaction and set the Export Date on BOTH the debit and credit transactions to the current date. |  |

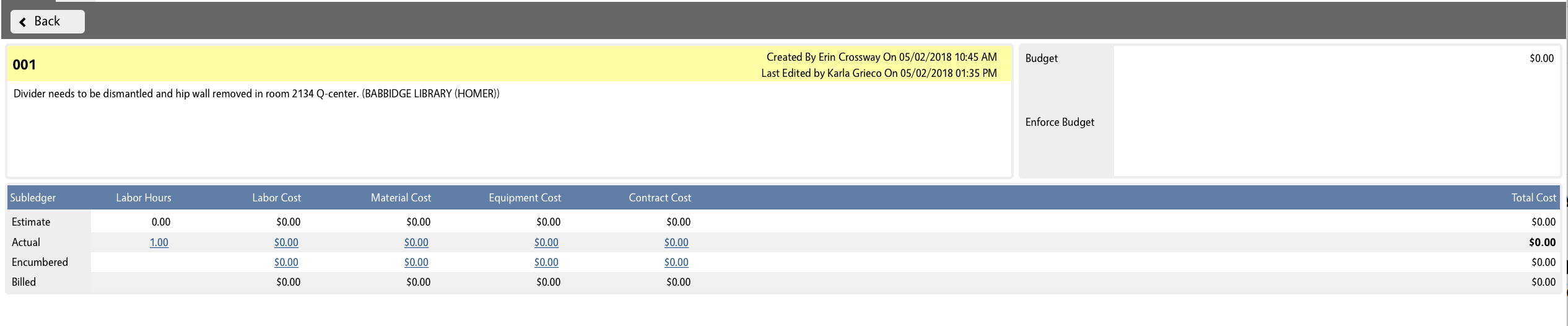

| Before taking any more steps VALIDATE THE COST ANALYSIS on the Phase has removed all expenses related to the billing reversal |  |

| In order to still capture the costs, the cost data needs to be re-applied to the work order | |

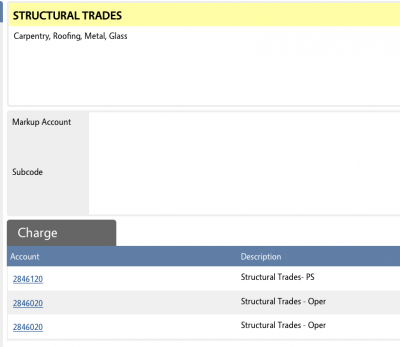

| Confirm the correct operational accounts. These will need to be used on the work order journal entry |  |

From AiM WorkDesk:

Enter the total costs that were reversed on the correct subledger and apply them to the work order using the PS or Operational accounts (subledger dependent). Set the Posted value to Yes and Save |

|

| Before taking any more steps VALIDATE THE COST ANALYSIS on the Phase shows the reversed costs now applied as actuals in the correct subledger with nothing in the billed totals related to this item |  |

| Make sure to set the phase to a non-billable status immediately or prior to the next billing. |  |

Issues to resolve before implementation:

Will there ever be a reversal on transactions for work that has other transactions that will be billed in the future? If so the last step to making this work needs to be understood and considered

Roles used:

- Finance – Finance will follow these procedures whenever GECs are initiated in KFS to reverse billings from AiM so that billing totals are accurately reflected in AiM against work